UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant |  | Filed by a party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material Pursuant to §240.14a-12 |

ORMAT TECHNOLOGIES, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | |

| No fee required |

| Fee paid previously with preliminary materials |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Preliminary Proxy Statement

Subject to completion, dated March 15, 2024

In 2023, the Company’s Management celebrated the 20th Anniversary of Ormat Technologies, Inc.’s Listing on the New York Stock Exchange (NYSE) by ringing the Opening Bell.

| MISSION | Being a global leader and provider of renewable energy, while building a geographically balanced portfolio of geothermal, recovered energy and storage assets. | |

| VALUES | CONSTANT RENEWAL | |

| We continually seek new challenges, advance new technologies, enter new fields and test new business models. | ||

| COURAGE | ||

| We act with the certainty that comes from knowledge, experience, prudent risk management and an unwavering focus on delivering the best results for our clients. | ||

| STABILITY | ||

| It defines our workforce, technologies, products, facility performance and our firm financial foundation. | ||

| FULL COMMITMENT | ||

| We are fully committed to our stakeholders and to building a sustainable future. | ||

| CREATIVITY | ||

| We understand and fully appreciate the uniqueness of the customers we serve and the vital role creativity plays in finding the right solutions. |

March [27], 2024

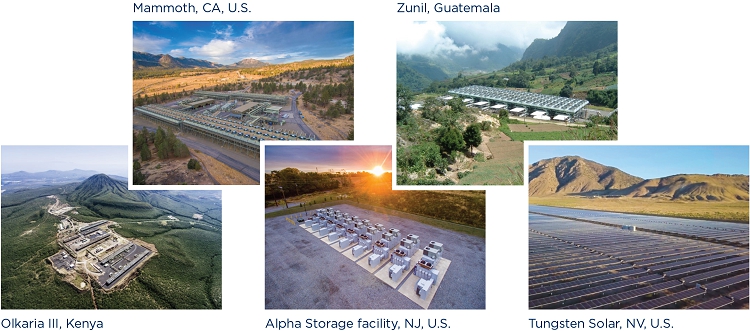

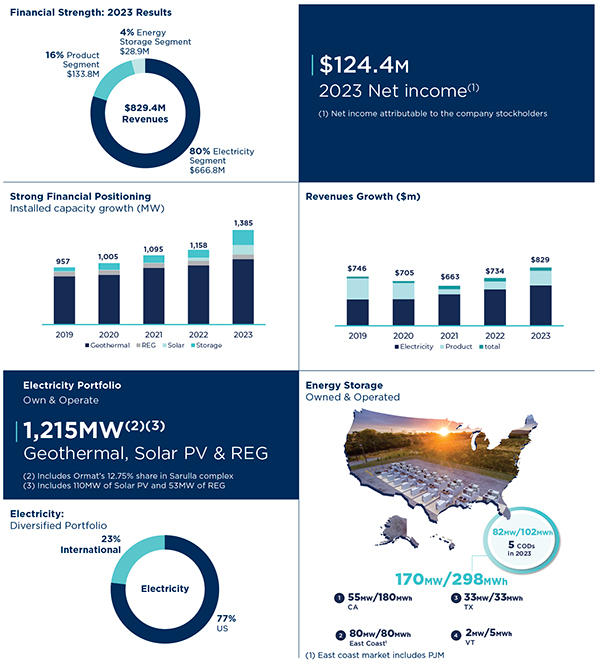

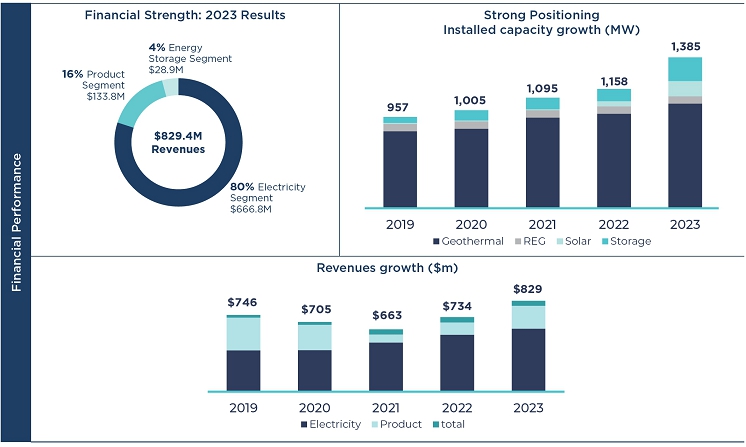

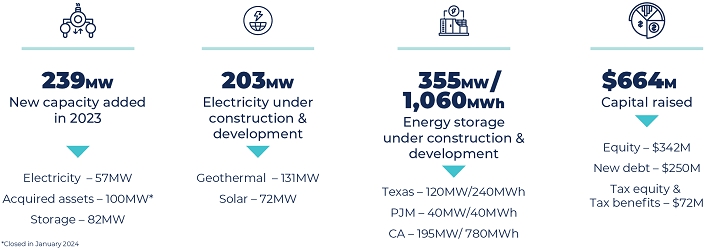

2023 was another successful year for Ormat. During 2023, our annual net income attributable to the Company’s stockholders increased by 88.9% and our total annual revenues increased by 13.0% compared to 2022. Our annual product segment revenues grew 87.3%, our electricity segment grew 5.5% and our energy storage segment declined 6.8% compared to 2022. Our global portfolio reached 1,385MW at the end of 2023, representing a 19.6% increase compared to 2022, and includes 82MW added from new energy storage facilities, 57MW added from new geothermal and solar assets, 100MW added from newly acquired assets and a 12MW reduction in our operating geothermal assets. This expansion aligns with our multiyear capacity expansion targets and further strengthens our earnings generation capabilities in 2024 and beyond.

Our strong results in 2023 were the result of the successful operation of new projects that we launched in 2022 and the commercial operation of our geothermal, solar PV and energy storage portfolio throughout the year. In addition, in May 2023, we successfully brought our Heber 1 power plant in California back online following a shutdown due to a fire incident that occurred in February 2022. The Heber complex is now generating approximately 91MW.

20th Year of Trading on the NYSE

- Doron Blachar, CEO |

MESSAGE FROMIn 2024, we expect to continue capturing the benefits of our successful growth strategy, further expand our capacity in the electricity and storage segments and increase our revenues. We are committed to investing in high-quality geothermal and energy storage assets to position us for continued growth, while also contributing to the global push to reduce greenhouse gas (“GHG”) emissions and utilize the worlds renewable energy resources.

OUR CHAIRMAN OF THE BOARD

Our core business operations are dedicated to addressing critical energy resilience and climate challenges and we are currently benefiting from the tailwinds supporting domestic geothermal and energy storage driven by such global decarbonization efforts.

We remain firm in our dedication to delivering value to our stockholders and advancing sustainable communities and economies in the regions in which we operate.

In 2023, we issued a comprehensive sustainability report for 2022 in accordance with the Global Reporting Initiative (“GRI”) Standards and the standards of the Sustainability Accounting Standards Board (“SASB”). This was the Company’s fifth sustainability report written according to the GRI standards and the third guided by SASB’s requirements and recommendations. During 2022, we saw an impressive 19% reduction in our annual average Scope 1 and 2 GHG emissions and a 25% reduction in GHG emissions intensity, compared to our 2019 baseline levels.

As a renewable energy company with unique geothermal technology, we believe that renewable energy providers like us play a pivotal role in the global fight against climate change. We offer communities around the world a clean, reliable and sustainable power source. We take this role very seriously and are proud of our dedicated and talented workforce and their commitment to Ormat’s mission. We see a bright future at Ormat and appreciate your trust and confidence in our company.

Thank you for your investment in Ormat.

|  | |

| Isaac Angel Chairman of the Board | Doron Blachar Chief Executive Officer |

ISAAC ANGEL | March 28, 2023TABLE OF CONTENTS

TO OUR STOCKHOLDERS:

ORMAT TECHNOLOGIES, INC. | 2024 PROXY STATEMENT

On behalf of the

ORMAT TECHNOLOGIES, INC. | 2024 PROXY STATEMENT

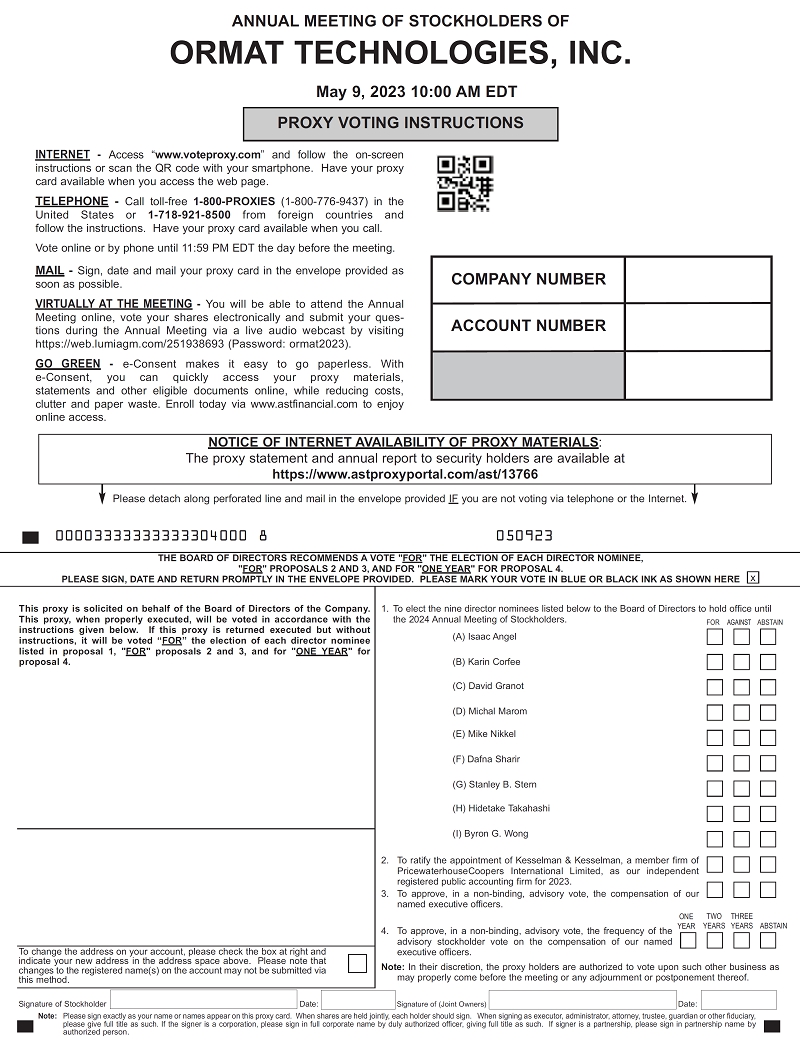

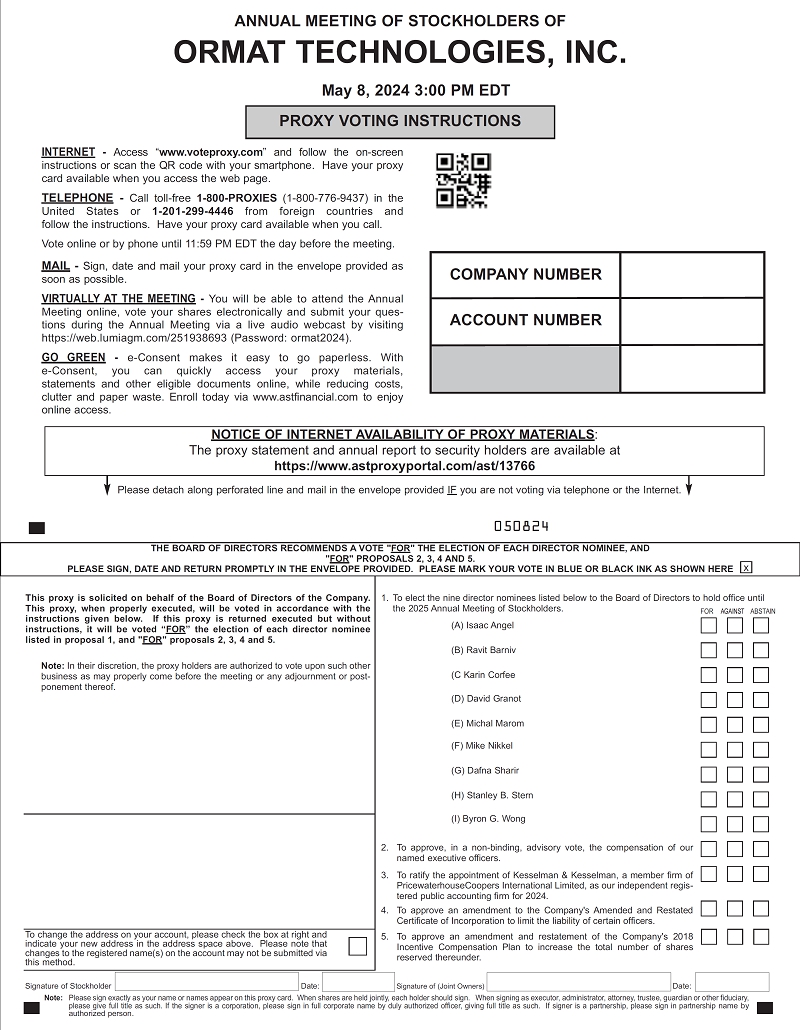

The Board of Directors I cordially invite you to attend the 2023 Annual Meeting of Stockholders(the “Board”) of Ormat Technologies, Inc. (“Ormat” or the “Company”) is making this Proxy Statement available to be heldyou in connection with the solicitation of proxies on May 9, 2023 at 10:00 a.m., Eastern Daylight Timeits behalf for the 2024 Annual Meeting of Stockholders (the “Annual Meeting”). The Annual Meeting will be held on May 8, 2024 at 3:00 p.m., Eastern Daylight Time. The Annual Meeting will be a completely virtual meeting, which will be conducted via live audio webcast.

This summary highlights information about the Company and certain information contained elsewhere in this Proxy Statement. You will be able to attendshould read the Annual Meeting online, vote your shares electronically and submit your questions during the Annual Meeting by visiting https://web.lumiagm.com/251938693 and following the instructions included in the enclosedentire Proxy Statement.Statement carefully before voting.

Only stockholders of record at the close of business on March 20, 2023 may vote at the Annual Meeting. Each stockholder of record is entitled to one vote for each share of common stock held at that time.

|  |  |  | |||

| DATE Wednesday, May 8, 2024 | TIME 3:00 P.M., Eastern Daylight Time | LOCATION Virtual at https://web.lumiagm.com/251938693 | RECORD DATE March 14, 2024 |

In accordance with the rules of the Securities and Exchange Commission, we sent a Notice of Internet Availability of Proxy Materials on or about March 28, 2023 to our stockholders of record as of the close of business on March 20, 2023. We also provided access to our proxy materials over the Internet beginning on that date. If you received a Notice of Internet Availability of Proxy Materials by mail and did not receive, but would like to receive, a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability of Proxy Materials.

Your vote is important to us. Whether or not you plan to attend the Annual Meeting, we strongly urge you to cast your vote promptly. You may vote over the Internet, as well as by telephone or by mail, or otherwise virtually at the Annual Meeting. Please review the instructions on the proxy card (or, if you hold your shares in “street name” through a broker, bank or other nominee, voting instruction form) regarding each of these voting options.

By order of the Board of Directors,

Isaac Angel

Chairman of the Board

| Proposal |

| |  Recommendation | Page | |

| |

| |

|

ITEMS OF BUSINESS:

The purposeElection to our Board of Directors of the Annual Meeting is to:

| FOR each of the | 15 | |||||

| Advisory vote on the compensation for our named executive officers | 32 | |||||

| Proposal 3 | Ratification of the appointment of Kesselman & Kesselman, a member firm of PricewaterhouseCoopers International Limited, as our independent registered public accounting firm | FOR | 59 | |||

| Approval of an amendment to the | FOR | 61 | ||||

| Approval of an amendment and restatement of the | ||||||

Stockholders will also transact any other business that may properly come before the Annual Meeting and any adjournments or postponements thereof.

These items of business are more fully described in the Proxy Statement accompanying this Notice of Annual Meeting.

WHO CAN VOTE: The record date for the Annual Meeting is March 20, 2023.14, 2024. Only stockholders of record at the close of business on that date may vote at the Annual Meeting or any adjournment thereof.

VOTING: Whether or not you plan to attend the Annual Meeting, we strongly urge you to cast your vote promptly. You may vote over the Internet, as well as by telephone or by mail, or otherwise virtually at the Annual Meeting. Please review the instructions on the proxy card (or, if you hold your shares in “street name” through a broker, bank or other nominee, voting instruction form) regarding each of these voting options.

By order of the Board of Directors,

JESSICA WOELFEL

General Counsel, Chief Compliance Officer and

Corporate Secretary

March 28, 2023

ORMAT TECHNOLOGIES, INC.| | 2023 2024 PROXY STATEMENT 0402

TABLE OF CONTENTS

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 03

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 04

|

DEAR STOCKHOLDER,

2022 was a very strong year for Ormat. The Company had solid growth in each operating segment, resulting in a 10.7% year-over-year increase in total revenues and an 8.3% year-over-year increase in operating income. We added 78MW of new generating capacity to our operating portfolio with the addition of our 35MW CD4 plant in Mammoth, California and some expansion projects and hybrid Solar facilities, and we signed long-term power purchase agreements of up to 365MW in our Geothermal and Energy Storage segments. The Company also saw a notable recovery in our Product segment, with higher revenues, improved margins, and new product contracts that considerably increased our backlog to pre-COVID-19 levels.

In 2023, we expect to deliver meaningful revenue expansion and continued profitable growth for our investors. Our growth plans are aggressive, and we are motivated to expand our portfolio significantly and continue providing clean sustainable energy to our customers. The passage of the Inflation Reduction Act of 2022 (the “IRA”) in the United States was a very positive development for renewable energy companies, and we expect to take advantage of the IRA to reduce our capital needs in the coming years. We are focusing our efforts on Indonesia and the United States, and see tremendous growth opportunities in both countries.

In 2022, we strengthened our already strong commitment to environmental, social and governance-related (“ESG”) issues. We issued a comprehensive sustainability report in accordance with the GRI Standards and the standards of the Sustainability Accounting Standards Board, and we successfully met our target of five percent annual average absolute reduction in Scope 1 and 2 greenhouse gas (“GHG”) emissions measured against 2019 base levels. Our Board of Directors also established an ESG Committee in February 2023.

We believe that we successfully weathered the labor challenges that have plagued most employers over the last year. Throughout these challenging times, we believe that we have continued to operate our power plants effectively and efficiently, have continued to build for ourselves and our clients operating power plants, and have engaged in significant drilling campaigns for projects all over the world. I am proud of our dedicated and talented workforce and their commitment to Ormat’s mission.

At Ormat, we take our job of providing clean, sustainable energy very seriously. As we look to the future, we will continue our aggressive development program and expect increased growth as we continue to lead in geothermal energy development and increase our solar and storage holdings. We see a bright future at Ormat and appreciate your trust and confidence in our company.

Thank you for your investment in Ormat.

Doron Blachar

Chief Executive Officer

ORMAT TECHNOLOGIES, INC.|2023 PROXY STATEMENT05

The Board of Directors (the “Board”) of Ormat Technologies, Inc. (“Ormat” or the “Company”) is making this Proxy Statement available to you in connection with the solicitation of proxies on its behalf for the 2023 Annual Meeting of Stockholders (the “Annual Meeting”). The Annual Meeting will be held on May 9, 2023 at 10:00 a.m., Eastern Daylight Time. The Annual Meeting will be a completely virtual meeting, which will be conducted via live audio webcast.

This summary highlights information about the Company and certain information contained elsewhere in this Proxy Statement. You should read the entire Proxy Statement carefully before voting.

|  |  | |

Recommendation | ||||||

ORMAT TECHNOLOGIES, INC.|2023 PROXY STATEMENT06

| How to Vote | Stockholders of Record (Shares registered in your name with | Street Name Holders (Shares held through a broker, bank or other nominee) | |||

Internet | Visit the applicable voting website and follow the on-screen instructions. | www.voteproxy.com | Refer to voting instruction form. | ||

Telephone | Within the United States, U.S. Territories and Canada, call toll-free. | +1 (800) 776-9437 | Refer to voting instruction form. | ||

| Complete, sign and mail your proxy card (if a stockholder of record) or voting instruction form (if a street name holder) in the self-addressed envelope provided to you. | ||||

Virtually | Attend the Annual Meeting and cast your vote on the meeting website. | https://web.lumiagm.com/251938693, | Refer to voting instruction form. | ||

If you own shares that are traded through the Tel Aviv Stock Exchange (“TASE”), you may vote your shares in one of the following ways:

| • | By Mail / E-Mail. Complete, sign and date the proxy card and attach to it an ownership certificate from the TASE Clearing House member through which your shares are registered (i.e., your broker, bank or other nominee), indicating that you were the beneficial owner of the shares as of the record date of March |

| • | By Voting Electronically. Vote your shares through the electronic voting system of the Israel Securities Authority (https://votes.isa.gov.il), subject to proof of ownership of the shares on the Record Date, as required by law. Voting through the electronic voting system will be allowed until |

YOUR VOTE IS IMPORTANT TO US. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE CAST YOUR VOTE PROMPTLY. YOU MAY VOTE OVER THE INTERNET, BY PHONE OR BY SIGNING AND DATING A PROXY CARD AND RETURNING IT TO US BY MAIL.

ORMAT TECHNOLOGIES, INC. | 2024 PROXY STATEMENT 05

By submitting your proxy using any of the methods specified in the Notice, you authorize each of Doron Blachar, our Chief Executive Officer, Assaf Ginzburg, our Chief Financial Officer, and Jessica Woelfel, our General Counsel, Chief Compliance Officer, and Corporate Secretary, to represent you and vote your shares at the Annual Meeting in accordance with your instructions. AnyYou may also vote your shares to adjourn the Annual Meeting and will be authorized to vote your shares at any postponements or adjournments of the Annual Meeting.

ORMAT TECHNOLOGIES, INC.|2023 PROXY STATEMENT07By Order of the Board of Directors.

You are being asked to vote on the following nine nominees for directors to serve on our Board for a one-year term expiring at the 2024 Annual Meeting of Stockholders. Information about each director’s experiences, qualifications, attributes and skills can be found in the sections below titled “Proposal 1 – Election of Directors” and “Our Board’s Skills, Experience and Backgrounds.”

| Committee Memberships | |||||||||||||

| Name | Age | Director Since | Independent | Audit | Compensation | Nominating & Corporate Governance | Investment | ESG | |||||

Isaac Angel  | 66 | 2020 | |||||||||||

| Karin Corfee | 62 | 2022 |  |  |  | ||||||||

| David Granot | 76 | 2012 |  |  |  |  | |||||||

| Michal Marom | 53 | 2022 |  |  |  | ||||||||

| Mike Nikkel | 58 | 2021 |  |  |  | ||||||||

| Dafna Sharir | 54 | 2018 |  |  |  | ||||||||

| Stanley B. Stern+ | 65 | 2015 |  |  |  |  | |||||||

| Hidetake Takahashi | 52 | 2020 |  |  | |||||||||

| Byron G. Wong | 71 | 2017 |  |  |  | ||||||||

JESSICA WOELFEL

| |

| |

General Counsel, Chief Compliance Officer and

Corporate Secretary

March [27], 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF INTERNET AVAILABILITYPROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 8, 2024:

We are taking advantage of Securities and Exchange Commission (“SEC”) rules that permit companies to furnish proxy materials to stockholders via the Internet. As a result, we are mailing to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”). If you received a Notice by mail, you will not receive a printed copy of our proxy materials unless you specifically request one by following the instructions contained in the Notice. The Notice instructs you on how to access our proxy materials, including this Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 20222023 (“Fiscal 2022”2023”), via the Internet at https://www.astproxyportal.com/ast/13766, as well as how to vote online or by telephone. We are first making this Proxy Statement and the accompanying materials available to our stockholders on or about March 28, 2023.[27], 2024.

| CD4 Power Plant, Mammoth, California

ORMAT TECHNOLOGIES, INC.| |20232024 PROXY STATEMENT 0806

The Board of Directors (the “Board”) of Ormat Technologies, Inc. (“Ormat” or the “Company”) is making this Proxy Statement available to you in connection with the solicitation of proxies on its behalf for the 2024 Annual Meeting of Stockholders (the “Annual Meeting”). The Annual Meeting will be held on May 8, 2024 at 3:00 p.m., Eastern Daylight Time. The Annual Meeting will be a completely virtual meeting, which will be conducted via live audio webcast.

This summary highlights information about the Company and certain information contained elsewhere in this Proxy Statement. You should read the entire Proxy Statement carefully before voting.

At Ormat, we’re always on, delivering renewable power and energy solutions to our customers around the clock and around the world. Clean, reliable energy solutions provided from geothermal power, recovered energy, as well as solar photovoltaic (“PV”) and energy storage solutions, is our expertise, commitment and focus.

With over five decades of experience, Ormat is a leading geothermal company and the only vertically integrated company engaged in geothermal and recovered energy generation (“REG”), with robust plans to accelerate long-term growth in the energy storage market and to establish a leading position in the U.S. energy storage market. Ormat owns, operates, designs, manufactures and sells geothermal and REG power plants primarily based on the Ormat Energy Converter—a power generation unit that converts low-, medium- and high-temperature heat into electricity. Ormat has engineered, manufactured and constructed power plants, which it currently owns or has installed for utilities and developers worldwide, totaling approximately 3,200 MW3,200MW of gross capacity.capacity, including geothermal and REG sites, as of December 31, 2023. Ormat leveragedleverages its core capabilities in the geothermal and REG industries and its global presence to expand its activity intoactivities in clean energy storage services, solar Photovoltaic (PV)production and energy storage plus Solar PV. solutions.

Ormat’s current total generating portfolio is 1,158 MW1,385MW with a 1,070 MW1,215MW geothermal solar PV and solarREG generation portfolio that is spread globally in the U.S., Kenya, Guatemala, Indonesia, Honduras, and Guadeloupe, and an 88 MW170MW energy storage portfolio that is located in the U.S. With the objective of leading the way in renewable energy, weWe are motivated to identify our opportunities and risks with respect to climate change and take efforts to reduce our GHG emissionsenvironmental impact as it relates to climate, water use, and improve our energy efficiency.waste reduction. Our geothermal power plants have farsignificantly lower emissions of carbon dioxide compared to power plants that run on coal or other fossil fuels and provide a sustainableconsistent and stable power supply, making them an ideal source of baseload energy.renewable ‘baseload’ power.

As a global company, we are proud of the impact we make in the communities we serve—not only through the delivery of clean, renewable energy, but through the social impacts we make around the world. We employ approximately 1,480 people and are committed to hiring from local communities. Wherever we work, our objectives are to build and retain an engaged, well-trained, diverse and equitable workforce.

ORMAT TECHNOLOGIES, INC.| |20232024 PROXY STATEMENT 0907

At the core of our business strategy, we strive to advance a number of goals and work toward accomplishing them in several ways:

| 1 | 2 | 3 | 4 | 5 | 6 |

Increasing clean energy production capacity

We aim to deliver more renewable energy through the development and construction of new geothermal power plants to both our own portfolio and to third parties, expansion of our geographical reach, and acceleration of our energy storage assets. | Promoting innovation in all our activities

We strive to establish and operate our sites in the most innovative way, and our R&D department regularly searches for innovations to improve the efficiency of our operations, including environmental performance, at existing and new sites. | Maintaining synergy with the communities in which we operate

We work to understand the needs and concerns of local communities near our sites, and to build lasting relationships and community engagement programs that meet their needs. | Prioritizing and developing our people

We strive to provide a diverse and inclusive working environment where employees can fulfill their professional goals, and to instill a safe workplace culture. | Commitment to a fair supply chain

We see great importance in managing a fair supply chain and working with suppliers and business partners with good human rights practices, and we are committed to complying with applicable laws and human rights commitments. | Strong values for solid governance

We strive to conduct our business everywhere with honesty and integrity, and we believe candor, openness, and fairness must be demonstrated by every Ormat employee, manager, and director at all times. |

Ormat has been sustainably generating power since 1965, and we remain committed to providing renewable energy safely, economically, and in an environmentally responsible manner. We are committed to continuingaccomplishing our goals in a transparent, ethical manner that supports the development and growth of our employees, partners, investors, and the communities in which we operate. As such, a focus on environmental, social, and governance-related (“ESG”) efforts. As a renewable energy solution provider,governance (ESG) issues is part of our DNA, and we seek to ensure that our business and ESG strategies are motivated to identify our opportunities and risks with respect to climate change and take efforts to reduce our greenhouse gas emissions (“GHG”) and improve our energy efficiency.fundamentally aligned. We have establishedpreviously set a target of five percent annual average absolute reduction in Scope 1 (direct emissions) and Scope 2 (indirect emissions) GHG emissions measured against the 2019 base levels. Inlevels and exceeded this target in 2020, 2021 and 2022.

Due to our growth and expected future growth both in the geothermal and energy storage segments, we exceededdetermined in 2023 to set an intensity reduction goal, as opposed to an absolute reduction goal, which we believe is better suited to our goal,emissions profile. Our target is now five percent annual reduction in Scope 1 and reduced our annual average by more than 11% in comparison2 GHG emissions intensity (tCO 2e/MWh) compared to our 2019 baseline. Our progress towards this goal is reviewed annuallybase year.

Establishment of ESG Committee in 2023

In 2023, the Board of Directors established an ESG Committee as part of the Company’s commitment to environmental, social and reported in our Sustainability Reports. Additionally, in 2021, we began togovernance matters, with a particular emphasis on environmental matters.

We also align our disclosures with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). As part of this effort,(“TCFD”), as well as with the GRI Standards and guided by the TCFD’s recommendations, we are adding climate-related scenario analysis to our business development and strategy decision-making processes. Aligning to the TCFD standards further strengthens our awareness of the impact Ormat and its operations have on climate change. We have been sustainably generating power since 1965, and we remain committed to providing renewable energy safely, economically, and in an environmentally responsible manner. We aim to act as responsible stewards of the environment and to create and foster a corporate culture for our employees that encompasses the highest standards of fairness and equality. We have recently added updates on social activities such as diversity and inclusion training for employees and our recruiting efforts to attract, advance, and retain a more diverse talent pool. This work surrounding diversity and inclusion remains fundamental to our business as we look to drive both our short-term and long-term initiatives in a sustainable and socially responsible manner. These commitments are applied through our corporate governance, business activities, policies, and strategic objectives.

At the core of our business strategy, we strive to advance a number of goals and work toward accomplishing them in several ways:

|

|

|

|

|

|

|  |  |  |  |  |

We report our progress on environmental goals and commitments annually in our Sustainability Reports, including, but not limited to, our climate change mitigation measures, biodiversity conservation, and water management efforts. A copy of our most recent Sustainability Report is accessible, free-of-charge, in the Sustainability section of our website at www.ormat.com.The contents of our website, including the Sustainability Reports, are not part of or otherwise incorporated by reference into this Proxy Statement.

At Ormat, we are committed to the advancement and development of people—both our employees and the members of the communities where we operate. We are dedicated to creating a work environment that is diverse and inclusive, based on the principles of equality for all people. We believe diversity, equity, inclusion, and belonging (DEIB) is a key component for developing innovative, diverse ideas and for supporting every employee in reaching their individual potential. As of December 31, 2023, we employed 1,576 employees and are committed to hiring from local communities.

ORMAT TECHNOLOGIES, INC.| |20232024 PROXY STATEMENT 1008

ORMAT TECHNOLOGIES, INC. | 2024 PROXY STATEMENT 09

| • | Completed a 6MW upgrade to the Dixie Valley power plant in Nevada, which allows the Company to maximize its favorable long-term power purchase agreement. |

| • | Completed the 6MW Brady solar facility that supply the auxiliary needs of the Brady geothermal power plant and thereby increasing the net geothermal power sold to the grid. |

| • | Successfully resumed operations at the Heber 1 power plant in California, after the plant temporarily shut down due to a fire incident that occurred in February 2022. |

| • | Received Hawai‘i Public Utilities Commission’s approval of the Power Purchase Agreement between Puna Geothermal Venture (PGV) and Hawaiian Electric. The approval follows PGV’s completion and submission of its final environmental impact statement for operations in Puna, Hawai‘i. |

| • | Completed the acquisition of contracted operating geothermal and solar assets from Enel Green Power North America, which includes two contracted operating geothermal power plants and one triple hybrid geothermal, solar PV and solar thermal power plant with a total geothermal capacity of approximately 40MW and Solar PV of 20MW, two Solar assets with a total nameplate capacity of 40MW, and two greenfield development assets. The acquisition is expected to advance Ormat’s Electricity segment growth plans and further strengthen the Company’s presence in the U.S. renewable energy sector. |

| • | Signed a 25-year power purchase agreement with Dominica Electricity Services Ltd. for the development of a 10MW binary geothermal power plant in the Caribbean country of Dominica. |

| • | Secured a 15-year fixed price Storage service agreement with San Diego Community Power for the 20MW/40MWh Pomona 2 Energy Storage System located in Los Angeles County, California. |

| • | Secured an EPC contract with Mercury to construct and supply a 56MW geothermal power plant at Ngatamariki, New Zealand. |

| • | Signed an agreement with Eastland Generation Limited to build a 50MW power plant in New Zealand. |

| • | Commenced commercial operations at five battery storage facilities for 82MW/102MWh of combined capacity, with these projects becoming eligible for investment tax credits, which will allow the Company to reduce its income taxes and significantly improve the economics of these projects. |

| • | Commenced commercial operation of the 25MW North Valley project in Nevada. This project is selling energy to NV Energy under a 25-year long term contract. |

| ENVIRONMENT | 19% Absolute reduction in Scope 1 and 2 GHG emissionscompared with 2019 baseline |

| 25% Reduction in GHG emissions intensity (tCO2e/MWh) compared with 2019 baseline | |

| $431M Green convertible bonds | |

| SOCIAL | More than 30% women on the global Executive Management team |

| 25.3 Training hours per employee | |

| 0.7 Total Recordable Incident Rate (TRIR) | |

| Approximately 2% of net income donated to communities | |

| GOVERNANCE | Our corporate governance practice is defined by honesty, openness andfairness |

| We are constantly improving our governance and our level of disclosureon related topics, such as anti-corruption, executive remuneration and regulatory compliance | |

| ESG Board committee established in 2023 | |

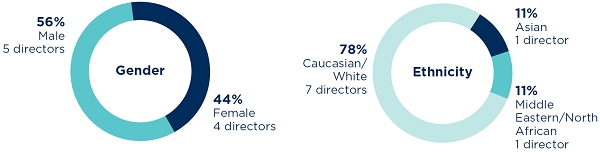

| 33% Female representation in our current Board of Directors (and 44% counting all of our nominees) | |

| 3 out of 5 Board committees are led by women |

| * | Environmental and social data is taken from our most recent sustainability report, which provides information as of 2022. |

ORMAT TECHNOLOGIES, INC. | 2024 PROXY STATEMENT 10

Our executive officers are appointed by, and serve at the discretion of, our Board of Directors. The following sets forth certain information with respect to our executive officers as of March 28, 2023.[27], 2024. Aggregate information regarding the Board throughout this section assumes Ms. Barniv’s election.

Age 56 | DORON BLACHAR | |

Doron Blachar has served as our Chief Executive Officer since July 1, 2020. Prior to that, Mr. Blachar served as the Company’s Chief Financial Officer from April 2013 to May 2020 and as President from November 2019 to July 2020. From 2011 to 2013, Mr. Blachar served as a member of the board of A.D.O. Group Ltd., a TASE-listed company. From 2009 to 2013, Mr. Blachar was the CFO of Shikun & Binui Ltd. From 2005 to 2009, Mr. Blachar served as Vice President—Finance of Teva Pharmaceutical Industries Ltd. From 1998 to 2005, Mr. Blachar served in a number of positions at Amdocs Limited, including as Vice President—Finance from 2002 to 2005. Mr. Blachar earned a BA in Accounting and Economics and an MBA from Tel Aviv University. He is also a Certified Public Accountant in Israel. |

Age 48 | ASSAF GINZBURG | |

Assaf Ginzburg has served as our Chief Financial Officer since May 10, 2020. Since October 2022, Mr. Ginzburg has served as a member of the board of Ithaca Energy plc, a company listed on the London Stock Exchange. Mr. Ginzburg also held several positions, including Executive Vice President and Chief Financial Officer of Delek US Holdings, Inc. (NYSE: DK) and Delek Logistics Partners, LP (NYSE: DKL) from 2013 to 2017 and from 2019 to May 2020, and has over 15 years of experience in the energy industry. Mr. Ginzburg earned a BA in Economics and Accounting from Tel Aviv University, and he has been a member of the Israeli Institute of Certified Public Accountants since 2001. |

Age

| 62 | |

Executive Vice President— Electricity Segment | SHIMON HATZIR | |

Shimon Hatzir has served as Executive Vice President—Electricity Segment since April 1, 2021. Mr. Hatzir served in various roles at the Company for 32 years, most recently, beginning in October 2018 as General Manager of our Energy Storage segment. Previously, Mr. Hatzir has served as Executive Vice President, Engineering and Research and Development at the Company. Mr. Hatzir holds a Bachelor of Science in Mechanical Engineering from Tel Aviv University as well as a Certificate from the Executive Management Program at Technion Israel Institute of Management. |

ORMAT TECHNOLOGIES, INC.|2023 PROXY STATEMENT11

Age 59

| OFER BEN YOSEF | |

Ofer Ben Yosef has served as our Executive Vice President—Energy Storage and Business Development since January 1, 2021. From April 2020 until January 2021, Mr. Ben Yosef served as our Executive Vice President—Business Development, Sales and Marketing. From 2008 to 2020, Mr. Ben Yosef served as a Division President at Amdocs Ltd. From 2000 to 2008, Mr. Ben Yosef served at other operational roles at Amdocs Ltd. From 1996 to 2000, Mr. Ben Yosef served as IT manager at AIG Israel. He earned a BA in Earth Science from Bar Ilan University, a BA in Software Development from Tel Aviv University and an MBA from Bar Ilan University. |

Age 47 | JESSICA WOELFEL | |

Jessica Woelfel has served as our General Counsel and Chief Compliance Officer since January 25, 2022, and has served as our Corporate Secretary since November 2, 2022. Ms. Woelfel previously served as our Interim General Counsel and Chief Compliance Officer from March 2021 to January 2022, and as Vice President, U.S. Legal for the Company’s business in the United States from January 2019 to March 2021. Ms. Woelfel has more than 20 years of legal experience and, prior to joining the Company, was a partner at McDonald Carano LLP, in Reno, Nevada from 2010 to 2018 and an associate at Sonnenschein, Nath and Rosenthal LLP in San Francisco, California. Ms. Woelfel holds a Bachelor’s degree from the University of California, Berkeley and a J.D. from the University of California, Hastings College of Law. |

ORMAT TECHNOLOGIES, INC.| |20232024 PROXY STATEMENT 1211

The Board recommends a vote FOR each director nominee. See Page 15

You are being asked to vote on the following nine nominees for directors to serve on our Board for a one-year term expiring at the 2025 Annual Meeting of Stockholders. Information about each director’s experiences, qualifications, attributes and skills can be found in the sections below titled “Proposal 1 – Election of Directors” and “Our Board’s Skills, Experience and Backgrounds.” Aggregate information regarding the Board throughout this section assumes Ms. Barniv’s election.

| Committee Memberships | |||||||||||||||||||||

| Name | Age | Director Since | Independent | Audit | Compensation | Nominating & Corporate Governance | Investment | ESG | |||||||||||||

Isaac Angel  | 67 | 2020 | |||||||||||||||||||

| Ravit Barniv | 60 | — |  | ||||||||||||||||||

| Karin Corfee | 63 | 2022 |  |  |  |  | |||||||||||||||

| David Granot | 77 | 2012 |  |  |  |  |  | ||||||||||||||

| Michal Marom | 54 | 2022 |  |  |  |  | |||||||||||||||

| Mike Nikkel | 59 | 2021 |  |  |  | ||||||||||||||||

| Dafna Sharir | 55 | 2018 |  |  |  |  | |||||||||||||||

| Stanley B. Stern+ | 66 | 2015 |  |  |  |  |  | ||||||||||||||

| Byron G. Wong | 72 | 2017 |  |  |  | ||||||||||||||||

| Chairman of the Board |

| Chair of Committee |

| + | Lead Independent Director |

ORMAT TECHNOLOGIES, INC. | 2024 PROXY STATEMENT 12

| Board Skills and Experience | ||

| Senior Leadership and Strategy Experience as a senior executive at a large organization | 9/9 | |

| Public Company Corporate Governance Experience serving on the board of a public company and/or a strong understanding of corporate governance best practices | 7/9 | |

| Finance and Accounting Experience in financial accounting and reporting, auditing processes and standards, internal controls and/or corporate finance | 9/9 | |

| Capital Markets Experience with a range of capital raising transactions | 6/9 | |

| ESG Experience with corporate social responsibility practices, including sustainability | 5/9 | |

| Capital Projects Experience overseeing, managing or advising on large-scale capital projects | 5/9 | |

| Business Development Experience with developing and implementing strategies for growth, including M&A transactions | 8/9 | |

| Energy Industry Experience in the energy, power generation, renewables and/or utility sectors | 6/9 | |

| International Business Experience with managing international operations | 5/9 | |

| Information Technology/Cybersecurity Experience in information technology, including the importance of maintaining stakeholder trust through protecting their information | 5/9 |

ORMAT TECHNOLOGIES, INC. | 2024 PROXY STATEMENT 13

Our commitment to good corporate governance is reflected in several practices of our Board of Directors and its committees, as described below.

| Board independence | All directors are independent, other than Mr. Angel, our former CEO, and all committees are made up of independent directors. | |

| Executive sessions | Independent members of the Board and each of the committees meet regularly in executive session with no members of management present. | |

| Board evaluation | Each of the Board and its committees evaluates and discusses its respective performance and effectiveness annually. | |

| Engagement with stockholders | The Board and management value the perspectives of our stockholders and work to provide our stockholders with continuous and meaningful engagement. | |

| Director accountability | All directors must be elected annually, by majority vote of the stockholders (except in contested elections, where they are elected by plurality). | |

| Time commitment | We maintain stringent internal over-boarding standards for our directors, which reflect the standards of ISS and Glass Lewis. None of our directors is currently over-boarded under such standards. | |

| Compensation review | The Compensation Committee reviews the appropriateness of our executive officer and director compensation. | |

| Risk oversight | The Board and committees regularly review their oversight of risk and the allocation of risk oversight among the committees. | |

| Board refreshment | Subject to certain exceptions, directors will not be nominated for re-election to the Board if they have served on the Board for more than 15 years at the time of such proposed nomination. |

The Board recommends a vote FOR this proposal. See Page 32

The Board recommends a vote FOR this proposal. See Page 59

The Board recommends a vote FOR this proposal. See Page 61

The Board recommends a vote FOR this proposal. See Page 63

ORMAT TECHNOLOGIES, INC. | 2024 PROXY STATEMENT 14

Our Board currently consists of nine members. Under its governance agreement with us, our stockholder ORIX is no longer entitled to a second director nominee due to the sell-down of its equity stake in an underwritten public offering in 2022. However, our Board has determined to re-nominate all of the directors previously nominated by ORIX. Upon the recommendation of the Nominating and Corporate Governance Committee, the Board has considered and nominated the following slate of nominees for a one-year term expiring in 2024:2025: Isaac Angel, Ravit Barniv, Karin Corfee, David Granot, Michal Marom, Mike Nikkel, Dafna Sharir, Stanley B. Stern, Hidetake Takahashi, and Byron G. Wong. Hidetake Takahashi has not been nominated for re-election and will serve until the expiration of his current term at the Annual Meeting; Mr Takahashi was previously nominated by ORIX, whose nomination rights were reduced as a result of its equity sell-down in 2023. For more information, see “Transactions with Related Persons--Transactions with ORIX.” The Board, based upon the recommendation of the Nominating and Corporate Governance Committee, determined to nominate Ravit Barniv to serve as a director if she is elected by our stockholders at the Annual Meeting. Action will be taken at the Annual Meeting for the election of these nominees.

It is intended that the proxies delivered pursuant to this solicitation will be voted in favor of the election of Isaac Angel, Ravit Barniv, Karin Corfee, David Granot, Michal Marom, Mike Nikkel, Dafna Sharir, Stanley B. Stern, Hidetake Takahashi, and Byron G. Wong, except in cases of proxies bearing contrary instructions. In the event that these nominees should become unavailable for election, the persons named in the proxy will have the right to use their discretion to vote for a substitute in accordance with SEC rules.

Election of each director nominee requires the affirmative vote of the holders of a majority of votes cast for the election of each director at the Annual Meeting. Abstentions and “broker non-votes” will have no effect on the outcome of this proposal.

| OUR BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES NAMED ABOVE. |

The following information describes the offices held and other business directorships of each nominee required to be disclosed by SEC rules. Beneficial ownership of equity securities of the nominees is shown under the section entitled “Security Ownership of Certain Beneficial Owners and Management” below.

Age 67 Member of our Board since Chairman ofthe Board | ISAAC ANGEL | |||

DIRECTOR QUALIFICATIONS: • Extensive experience with our Company, management experience and institutional and strategic knowledge about our energy market, industry and our business | ||||

| BACKGROUND: Mr. Angel has served as Chairman of our Board since January 2021, and served as Executive Chairman of our Board from July 2020 to December 2020. Mr. Angel was also our CEO from 2014 to July 2020. Previously, Mr. Angel served as chairman of the board of directors of Gilat Satellite Networks Ltd. (Nasdaq: GILT), a U.S. public company, from March 2020 to March 2023, as a director of Frutarom Ltd. from 2008 until 2016 and Retalix Ltd. from 2012 until 2013, and as executive chairman of LeadCom Integrated Solutions Ltd. from 2008 to 2009. From 2006 to 2008, Mr. Angel served as Executive Vice President, Global Operations of VeriFone after it acquired Lipman Electronic Engineering Ltd. (“Lipman”), and from 1979 to 2006, he served in various positions at Lipman, including as its President and CEO. | |||

ORMAT TECHNOLOGIES, INC. | 2024 PROXY STATEMENT 15

Age 60 Director Nominee Prior Member of our Board from November 2015 to May 2021 Independent Director | RAVIT BARNIV DIRECTOR QUALIFICATIONS: • Extensive management and corporate governance experience EDUCATION: • BA, Economics and Philosophy, Tel Aviv University • MBA, Finance, Tel Aviv University • MA, Governance, specialization in counterterrorism, IDC Herzliya (now Reichman University) • MBA, Healthcare Innovation, IDC Herzliya (now Reichman University) BACKGROUND: Ms. Ravit Barniv was previously a member of our Board from November 2015 until May 2021. Ms. Barniv previously served as the chairperson of the board of directors of Tnuva Group, the largest food group in Israel, from 2013 to 2015, as a board member of Clalit Health Care, Israel’s largest healthcare provider, from November 2016 to October 2022. She also served as a chairperson of the board of directors of Shikun & Binui Ltd., an infrastructure, real estate and renewable energy group in Israel, from 2007 to 2012, and as CEO of Netvision Communications, an internet service provider and provider of integration and telecommunication services, from 2001 to 2007. | ||

Age 63 Member of ourBoard sinceJune 2022 IndependentDirector • Audit Committee • ESG Committee (Chair) | KARIN CORFEE | ||

DIRECTOR QUALIFICATIONS: • Depth of experience in the energy sector and expertise with strategic planning, renewables, energy storage and ESG | EDUCATION: • BS, Political Economy of Natural Resources, University of California at Berkeley • MS, Civil Engineering, Stanford University | ||

BACKGROUND:

|

Ms. Corfee has served on the board of directors of ClimeCo, a privately held global sustainability company, since September 2021 and the Center for Resource Solutions, a non-profit that creates policy and market solutions to advance sustainable energy, since March 2015. She is also the founder and CEO of KC Strategies LLC, a business consultancy firm specializing in energy, climate and sustainability services since its founding in April 2021. Ms. Corfee is an energy, ESG and management consultant and director with over three decades of experience assisting large corporations, utilities, government agencies, and investors with clean energy transition strategies. Previous work experience includes serving as Vice President of Professional & Advisory Services at Kevala, Inc., a power grid analytics company, from October 2021 to June 2022 where she built their professional advisory services team. From October 2019 through April 2021, Ms. Corfee served as a Partner at Guidehouse, a management consulting firm, where she oversaw the firm’s western energy practice. Ms. Corfee also served as Managing Director at Navigant Consulting, Inc., a management consulting firm from 2011 to its acquisition by Guidehouse in October 2019. Ms. Corfee also served as a Vice President at KEMA, Inc. (now DNV), a global energy consultancy company, from 1998 to 2011. Prior to consulting, Ms. Corfee worked for electric and gas utilities in North America, including Pacific Gas and Electric Company, City of Palo Alto Utilities, and Union Electric Company (now Ameren Corporation). | ||

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 13

| |||

Age 77 Member of ourBoard sinceMay 2012 IndependentDirector • Nominating and Corporate Governance Committee • Investment Committee (Chair) • ESG Committee | DAVID GRANOT | ||

DIRECTOR QUALIFICATIONS: • Extensive management, banking, and financial experience, and overall business knowledge | EDUCATION: • BA, Economics, Hebrew University • MBA, Hebrew University | ||

| OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: • Rav-Bariach (08) Industries Ltd. (retiring April 2024) • Bezeq The Israel Telecommunication Corp. Ltd. • M.L.R.N. Projects and Trading Ltd. (Chairman) • CLAL Insurance Enterprises Holdings Ltd. | ||

BACKGROUND: Mr. Granot currently serves on the boards of directors of Bezeq The Israel Telecommunication Corp. Ltd. (TASE: BEZQ), M.L.R.N. Projects and Trading Ltd. (where he is Chairman of the board) (TASE: MLRN), | |||

ORMAT TECHNOLOGIES, INC. | 2024 PROXY STATEMENT 16

Age 54 Member of ourBoard sinceJune 2022 IndependentDirector • Audit Committee (Chair) • Compensation Committee | MICHAL MAROM | ||

DIRECTOR QUALIFICATIONS: • Extensive corporate governance and financial experience | EDUCATION: • BA, Business, Israeli College of Management Academic Studies • MSF, Baruch College | ||

| OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS:

• Paz Oil Company Ltd. • REE Automotive Ltd. | ||

BACKGROUND: Ms. Marom has served on the board of directors and the audit and compensation committees of REE Automotive Ltd. (Nasdaq: REE), a U.S. public company, since July 2021 and is a current member of the board of directors | |||

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 14

| |||

Age 59 Member of ourBoard sinceMay 2021

IndependentDirector • Compensation Committee • Investment Committee | MIKE NIKKEL DIRECTOR QUALIFICATIONS: • Extensive experience in the energy and infrastructure sectors, across development, finance, legal and management | EDUCATION: • JD, University of Minnesota School of Law | |

BACKGROUND:

|

Mr. Nikkel currently serves as Senior Managing Director and Deputy Head of the Energy and Eco-Services Business Headquarters of ORIX, where he assists with global business development and management. Mr. Nikkel joined ORIX in 2016. He has held senior management positions in the energy and infrastructure sectors across development, finance, legal and management for more than 25 years. Mr. Nikkel started his career in the sector at the AES Corporation in 1996, where he became Vice President and Head of Business Development as well as Chief Financial Officer of the firm’s Asian operations before departing the company in 2003. Since that time, he has been Managing Director and a regional head at CLP Holdings, the Chief Executive Officer of a joint venture between CLP and the Mitsubishi Corporation, an Asia-based partner at private equity firm Global Infrastructure Partners, as well as the internal infrastructure and energy advisor to the Jardine Matheson and Astra International group of companies. He has previously served on a number of boards of directors and various committees, including the board and executive committee of Electricity Generating PLC of Thailand, a public company. | ||

Age 55 Member of ourBoard sinceMay 2018 IndependentDirector • Compensation Committee (Chair) • Nominating and Corporate Governance Committee | DAFNA SHARIR | ||

DIRECTOR QUALIFICATIONS: • Extensive domestic and international financial and legal experience, specifically in mergers and acquisitions | EDUCATION: • BA, Economics, Tel Aviv University • LLB, Tel Aviv University School of Law • LLM, New York University School of Law • MBA, INSEAD | ||

| OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: • Cognyte Software Ltd. • Gilat Satellite Networks Ltd. | ||

BACKGROUND: Ms. Sharir has served on the board of directors of Gilat Satellite Networks Ltd. (Nasdaq: GILT), a U.S. public company, since 2016, on the board of directors and audit committee of Cognyte Software Ltd. (Nasdaq: CGNT), a U.S. public company, since 2022. She has also served on the board of directors of Minute Media Inc., a private company, since 2021. From 2013 to 2018, she served on the board of directors of Frutarom Industries Inc., and from 2012 to 2015, she served on the board of directors of Ormat Industries Inc., which was merged into Ormat Systems Ltd. (“Ormat Systems”) in February 2015. Since 2005, Ms. Sharir has served as a consultant, providing mergers and acquisitions advisory services, including with respect to due diligence, structuring, and negotiation, to public and private companies around the world. From 2002 to 2005, she served as Senior Vice President—Investments of AMPAL-American Israel Corporation, formerly a U.S. public company, and was responsible for all of its acquisitions and dispositions. From 1999 to 2002, she served as Business Development—Director of Mergers and Acquisitions at AMDOCS and was responsible for international acquisitions and equity investments. | |||

ORMAT TECHNOLOGIES, INC.| | 2023 2024 PROXY STATEMENT17 15

Age 66 Member of ourBoard since November 2015 LeadIndependent Director • Audit Committee • Nominating and Corporate Governance Committee (Chair) • Investment Committee

| STANLEY B. STERN | ||

DIRECTOR QUALIFICATIONS: • Extensive management, strategic analysis, banking and financial experience across a broad spectrum of industries | EDUCATION: • BA, Economics and Accounting, City University of New York, Queens College • MBA, Harvard University | ||

| OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS:

• Audiocodes, Inc. (Chairman)

• Radware Ltd. | ||

• Tigo Energy, Inc. BACKGROUND:

Mr. Stern is the Managing Partner of Alnitak Capital, which he founded in 2013 to provide board level strategic advisory services and merchant banking services, primarily to companies in technology-related industries. From 1981 to 2000 and from 2004 to 2013, he was a Managing Director at Oppenheimer & Co, where, among other positions, he was head of the investment banking department and technology investment banking group. He also held positions at Salomon Brothers, STI Ventures and C.E. Unterberg. Mr. Stern has served as chairman of the board of directors of AudioCodes, Ltd. (Nasdaq: AUDC), a U.S. public company, since 2012, and serves as a member of the board of directors of the following U.S. public and private companies: | |||

| |||

|

| ||

Age Member of our Independent • |

• | ||

| |||

ESG Committee | BYRON G. WONG | ||

DIRECTOR QUALIFICATIONS: • Extensive experience and proficiency in understanding, developing and managing energy and power projects globally | EDUCATION: • BA, Economics, University of California, Los Angeles • MBA, University of California, Los Angeles | ||

|

Mr. Wong has been a private energy consultant following his retirement from Chevron Corporation (“Chevron”) at the end of 2012 after more than 31 years with Chevron, its affiliates and predecessor companies. While at Chevron, from 2001 to 2012, Mr. Wong was Senior Vice President — Commercial Development (Asia) for Chevron Global Power Company, managing a team of professionals in identifying and developing opportunities for independent power projects to monetize Chevron’s gas in the region, and also participating as a member of a decision review board for overseeing Chevron’s geothermal development opportunities in Indonesia and the Philippines. Prior to the merger with Chevron in 2001, Mr. Wong established and staffed the initial Asian office location for Texaco Power and Gasification in Singapore in 1999. Before moving to Singapore, from 1995 to 1999. Mr. Wong was based in London with Texaco Europe: first as the Director of New Business Development (Downstream) for Central/Eastern Europe and Former Soviet Union, with primary responsibility for developing Texaco’s downstream entry into this region, and later, from 1998 to early 1999 as Vice President of Upstream Corporate Development for Europe, Eurasia, Middle East and North Africa, focusing on opportunities for upstream oil and gas mergers, divestments and acquisitions. | ||

ORMAT TECHNOLOGIES, INC.| | 2023 2024 PROXY STATEMENT18 16

Board Highlights

| 6 | directors with gender and/or ethnic or racial diversity |  | 1 | director former CFO | |

| 4 | directors current or former CEOs |  | 7 | directors with international experience |

Election of

In considering each director nominee, requires the affirmative voteNominating and Corporate Governance Committee and the Board evaluated such person’s key qualifications, skills, experience and perspectives that he or she could bring to the Board, as well as existing commitments to other businesses, professional experience, understanding of the holdersCompany’s business environment and the composition and combined expertise of the existing Board. Certain of the skills considered by the Board are summarized in the matrix below. The fact that a majority of votes cast forparticular qualification, skill, experience or perspective is not listed below does not mean that the election of each director atnominee does not possess it or that the Annual Meeting. AbstentionsNominating and “broker non-votes” will have no effect onCorporate Governance Committee and the outcome of this proposal.Board did not evaluate it.

The Nominating and Corporate Governance Committee also considers traditional diversity factors such as age, gender and ethnic and racial background as set forth in the Company’s Corporate Governance Guidelines. In addition, under our Corporate Governance Guidelines, our Board shall at all times include a minimum of two female directors, subject to periods of director transitions. The Nominating and Corporate Governance Committee makes recommendations to the Board to ensure it is composed of directors with sufficiently diverse and independent backgrounds. The matrix below also provides additional information regarding our directors’ self-identified gender and race/ethnicity. Aggregate information regarding the Board throughout this section assumes Ms. Barniv’s election.

| ||||||||||||||||||

| Isaac Angel | Ravit Barniv | Karin Corfee | David Granot | Michal Marom | Mike Nikkel | Dafna Sharir | Stanley Stern | Byron Wong | ||||||||||

Senior Leadership and Strategy Experience as a senior executive at a large organization |  |  |  |  |  |  |  |  |  | |||||||||

Public Company CorporateGovernance Experience serving on the board of a public company and/or a strong understanding of corporate governance best practices |  |  |  |  |  |  |  | |||||||||||

Finance and Accounting Experience in financial accounting and reporting, auditing processes and standards, internal controls and/or corporate finance |  |  |  |  |  |  |  |  |  | |||||||||

Capital Markets Experience with a range of capital raising transactions |  |  |  |  |  |  | ||||||||||||

ESG Experience with corporate social responsibility practices, including sustainability |  |  |  |  |  | |||||||||||||

Capital Projects Experience overseeing, managing or advising on large scale capital projects |  |  |  |  |  | |||||||||||||

Business Development Experience with developing and implementing strategies for growth, including M&A transactions |  |  |  |  |  |  |  |  | ||||||||||

ORMAT TECHNOLOGIES, INC.| | 2023 2024 PROXY STATEMENT19 17

Our commitment to good corporate governance is reflected in several practices of our Board of Directors and its committees, as described below.

| Board | |||||||||||||||||||

Angel | Barniv | Karin Corfee | David Granot | Michal Marom | Mike Nikkel | Dafna Sharir | Stanley Stern | Byron Wong | |||||||||||

Energy Industry Experience in the energy, power generation, renewables and/or utility sectors |  |  |  |  |  |  | |||||||||||||

International Business Experience with managing international operations |  |  |  |  |  | ||||||||||||||

Information Technology/Cybersecurity Experience in information technology, including the importance of maintaining stakeholder trust through protecting their information |  |  |  |  |  | ||||||||||||||

| Gender | |||||||||||||||||||

| Isaac Angel | Ravit Barniv | Karin Corfee | David Granot | Michal Marom | Mike Nikkel | Dafna Sharir | Stanley Stern | Byron Wong | |||||||||||

| Male |  |  |  |  |  | ||||||||||||||

| Female |  |  |  |  | |||||||||||||||

| Non-Binary | |||||||||||||||||||

| Race/Ethnicity | |||||||||||||||||||

| Isaac Angel | Ravit Barniv | Karin Corfee | David Granot | Michal Marom | Mike Nikkel | Dafna Sharir | Stanley Stern | Byron Wong | |||||||||||

| Asian (excludes Indian/South Asian) |  | ||||||||||||||||||

| Black/African American | |||||||||||||||||||

| Caucasian/White |  |  |  |  |  |  |  |  | |||||||||||

| Hispanic/Latin American | |||||||||||||||||||

| Indian/South Asian | |||||||||||||||||||

| Middle-Eastern/North African |  | ||||||||||||||||||

| Native American/Alaskan Native | |||||||||||||||||||

| Native Hawaiian/Other Pacific Islander | |||||||||||||||||||

ORMAT TECHNOLOGIES, INC. | 2024 PROXY STATEMENT 20

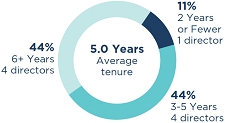

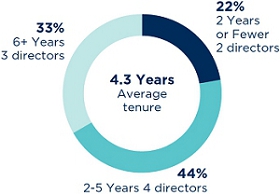

The Nominating and Corporate Governance Committee strives to maintain a healthy degree of Board refreshment and prevent entrenchment, while weighing the strong contributions delivered by directors with deep knowledge of our Company’s history and strategic long-term goals. Our Board is periodically refreshed with the addition of candidates whom we believe bring new ideas and fresh perspectives into the boardroom. We have added four new directors since 2019. As shown below, the Board’s balanced approach to Board tenure has resulted in an appropriate mix of long-serving and newer directors (which reflects the composition of the Board following the Annual Meeting assuming the election of all director nominees).

The New York Stock Exchange listing standards require a majority of our directors and each member of our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee to be independent. Under our Corporate Governance Guidelines and the NYSE rules, a director is not independent unless the Board affirmatively determines that he or she does not have a direct or indirect material relationship with the Company or any of its subsidiaries. The Board’s policy is to review and determine the independence of all incumbent directors annually, and to review and determine the independence of new director nominees and appointees when nominated or appointed.

The Board has established guidelines of director independence to assist it in making independence determinations, which conform to the independence requirements in the NYSE listing standards. In addition to applying these guidelines, which are set forth in our Corporate Governance Guidelines, the Board will consider all relevant facts and circumstances in making an independence determination. In the event a director has a relationship with the Company that is relevant to his or her independence and is not addressed by the independence guidelines, the Board will determine in its judgment whether such relationship is material.

The Nominating and Corporate Governance Committee undertook its annual review of director independence and made a recommendation to our Board regarding director independence. As a result of this review, our Board affirmatively determined that all of the director nominees and directors serving during Fiscal 2023, other than Mr. Angel, are independent under the guidelines for director independence set forth in the Corporate Governance Guidelines and for purposes of applicable NYSE standards, including with respect to committee service.

Our Board has also affirmatively determined that (i) each current member, each member who served during Fiscal 2023 and each nominee who will serve on our Audit Committee, assuming his or her election, is “independent” for purposes of audit committee membership under the applicable SEC rules and NYSE listing standards, and (ii) each current member, each member who served during Fiscal 2023 and each nominee who will serve on our Compensation Committee, assuming his or her election, is “independent” for purposes of compensation committee membership under the applicable SEC rules and NYSE listing standards.

ORMAT TECHNOLOGIES, INC. | 2024 PROXY STATEMENT 21

Assessment of Board Composition The Nominating and Corporate Governance Committee considers the appropriate size of the Board and |  | Candidate Identification In the event that vacancies are anticipated, or otherwise arise, the Nominating and Corporate Governance Committee considers potential director candidates. Where stockholders nominate directors pursuant to our bylaws, the Nominating and Corporate Governance Committee also considers the qualifications of these directors. |  | Candidate Evaluation The Nominating and Corporate Governance Committee interviews and evaluates potential director candidates to determine their qualifications to serve on our Board, as well as their compatibility with the culture of the Company, its philosophy and its Board and management. |  | Recommendation to the Board The Nominating and Corporate Governance Committee recommends director candidates to be presented to stockholders for election or, in the event of a vacancy, be appointed and subsequently presented to stockholders for election. |

Candidates may come to the attention of the Nominating and Corporate Governance Committee through current Board members, management, stockholders or other persons. The Nominating and Corporate Governance Committee may also utilize the services of professional search firms to identify and recruit qualified candidates for the Board.

Director candidates identified by stockholders will be evaluated in the same manner in which the Nominating and Corporate Governance Committee evaluates any other director candidates, as described below.

All recommendations for nomination received by the Corporate Secretary that satisfy our bylaw requirements relating to such director nominations will be presented to the Board for its consideration. Stockholders must, in particular, satisfy the notification, timeliness, consent and information requirements set forth in our bylaws. These requirements are also described under the section entitled “Stockholder Proposals for the 2024 Annual Meeting of Stockholders.”

The Nominating and Corporate Governance Committee is responsible for conducting appropriate inquiries into the backgrounds and qualifications of potential director candidates and their suitability for service on our Board. In evaluating each candidate, the Nominating and Corporate Governance Committee considers guidelines it has developed that set forth the criteria and qualifications for Board membership, including, but not limited to, relevant knowledge and individual qualifications (including professional experience, understanding of the Company’s business environment, and diversity of background and experience), personal qualities of leadership (including strength of character, wisdom, judgment, ability to make independent analytical inquiries, and the ability to work collegially with others), potential conflicts of interest, existing commitments to other businesses, and legal considerations such as antitrust issues, independence under applicable SEC rules and regulations and the NYSE listing standards, and overall fit with the composition and expertise of the existing Board.

| The Nominating and Corporate Governance Committee seeks to achieve diversity within the Board and works to further the Company’s goal of maintaining an environment free from discrimination based on race, color, religion, sex, sexual orientation, gender identity, age, national origin, disability, veteran status or any protected category under applicable law. |

This process is designed to provide that the Board includes members with diverse backgrounds, skills and experience, including appropriate financial and other expertise relevant to the business of the Company. Accordingly, in determining the pool from which Board nominees are chosen, the Nominating and Corporate Governance Committee is committed to seeking out highly qualified women and minority candidates, as well as candidates with diverse backgrounds, and experiences with the relevant mix of skills and other qualifying criteria as described above.

Our Board manages or directs the business and affairs of the Company, as provided by Delaware law, and conducts its business and affairs through meetings of the Board and five standing committees: the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee, the Investment Committee, and the ESG Committee. In addition, from time to time, special committees may be established under the direction of the Board of Directors when necessary to address specific issues. The following shows an overview of the composition of our Board, as further detailed in the below sections of this Proxy Statement.

ORMAT TECHNOLOGIES, INC. | 2024 PROXY STATEMENT 22

The Board maintains the flexibility to determine whether the roles of Chairman of the Board and CEO should be combined or separated, based on what it believes is in the best interests of the Company at a given point in time. The Board believes that this flexibility is in the best interest of the Company and its stockholders. The Board believes that one leadership structure is not more effective at creating long-term stockholder value, and the decision of whether to combine or separate the positions of CEO and Chairman should depend on a company’s particular circumstances at a given point in time. Specifically, an effective governance structure must balance the powers of the CEO and the independent directors and ensure that the independent directors are fully informed, are ready to discuss and debate the issues that they deem important, and are able to provide effective oversight of management. Our Board also believes that it should retain the flexibility to make this determination in the manner it feels will provide the most appropriate leadership for the Company from time to time. Our Chairman is appointed annually by the Board.

The Board’s leadership structure is designed to promote Board effectiveness and to appropriately allocate authority and responsibility between the Board and management. The Board believes that separating the Chair and CEO positions continues to be the appropriate leadership structure for the Company at this time, as it provides the Company and the Board with strong leadership and independent oversight of management and allows the CEO to focus primarily on the management and operation of our business. Factors that the Board considers in reviewing its leadership structure and making this determination include, but are not limited to, the current composition of the Board, the policies and practices in place to provide independent Board oversight of management, the Company’s circumstances and the views of our stockholders and other stakeholders.

Separation of CEO and Chairman Doron Blachar, CEO Isaac Angel, Chairman | Currently, the CEO position is separate from the Chairman of the Board position; Mr. Angel serves as Chairman, while Mr. Blachar serves as our CEO and does not serve on our Board. We believe this structure is appropriate corporate governance for us at this time, as it best encourages the free and open dialogue of competing views and provides for strong checks and balances. Additionally, the Chairman’s attention to Board and committee matters allows the CEO to focus more specifically on overseeing the Company’s day-to-day operations as well as strategic opportunities and planning. | |

Lead Independent Director Stanley Stern | Under our bylaws, a Lead Independent Director must be appointed where the Chairman and CEO are the same individual. If one is required, the Lead Independent Director must be elected via secret ballot by a majority vote of the independent directors. The Lead Independent Director’s responsibilities (to the extent one is appointed) include but are not limited to the following: • coordinating the activities of the independent directors; • determining the schedule of Board and committee meetings and preparing meeting agendas; • assessing the flow of information from management to ensure independent directors can perform their duties responsibly; • ensuring the Compensation Committee’s oversight of the Company’s incentive-based compensation policies and procedures; • in conjunction with the Compensation Committee, evaluating the CEO’s performance; • coordinating, preparing the agendas for and moderating executive sessions; and • recommending the membership of Board committees Currently, our Chairman and CEO are different individuals. However, because the Chairman of our Board, Mr. Angel, was determined by our Board not to be independent under our Corporate Governance Guidelines and the listing standards of the NYSE, our Board determined it was appropriate to appoint a lead independent director to enhance the Board’s ability to carry out effectively its roles and responsibilities on behalf of our stockholders. Stanley Stern currently serves as Lead Independent Director. |

ORMAT TECHNOLOGIES, INC. | 2024 PROXY STATEMENT 23

The Board of Directors has adopted written charters for each of the Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee, ESG Committee and Investment Committee. The charters of the Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee, EGS Committee and Investment Committee are available on the Company’s website in the “Investor Relations” section of our website at www.ormat.com. As noted above, all members are “independent” under applicable standards.

| Audit Committee | |

Members: 4 • Michal Marom (Chair, pictured) • Stanley B. Stern • Karin Corfee • Byron G. Wong Number of Meetings in Qualifications: • All members are “financially literate” under NYSE listing standards. • Ms. Marom has “accounting or related financial management expertise” under NYSE listing standards and is an “audit committee financial expert” under applicable SEC rules. | Key Responsibilities: • Selects an independent registered public accounting firm to be engaged to audit our financial statements • Annually reviews and discusses with • Reviews and discusses the audited annual financial statements and unaudited quarterly financial statements with the independent registered public accounting firm • Discusses with management and the independent registered public accounting firm any significant financial reporting issues and judgments and the adequacy of • Annually prepares the Audit Committee report • Oversees our internal audit function • Oversees Sarbanes-Oxley Act compliance • Manages and reviews our compliance with legal and regulatory requirements with respect to accounting policies, internal controls and financial reporting and with our Code of Business Conduct and Ethics • Oversees the whistleblower ethics hotline and the procedures established by the Company for receiving and addressing anonymous complaints regarding financial or accounting irregularities • Reviews and approves or ratifies related person transactions |

Members: 3 • Dafna Sharir (Chair, pictured) • Michal Marom • Mike Nikkel Number of Meetings in 2023: 5 | Key Responsibilities:

• Annually evaluates the performance of our CEO and other executive officers in light of these goals and objectives and their individual achievements and recommends to our Board for approval the compensation of our CEO and other executive officers • Periodically reviews and approves of all other elements of our CEO’s and other executive officers’ compensation, including cash-based and equity- based awards, employment, severance or change in control agreements, and any special or supplemental compensation and benefits for our CEO and other executive officers • Makes recommendations to our Board with respect to the adoption, amendment, termination or replacement of incentive compensation, equity- based plans, revenue sharing plans or other compensation plans maintained by the Company • Makes recommendations to our Board as to the appropriate compensation for Board members • Annually reviews the “Compensation Discussion and Analysis,” recommends its inclusion in the proxy statement and prepares the Compensation Committee report • Makes recommendations to our Board as to changes in Ormat’s general compensation philosophy • Monitors Ormat’s compliance with SEC and NYSE rules and regulations regarding “say-on-pay” and binding stockholder approval of certain executive compensation |

ORMAT TECHNOLOGIES, INC. | 2024 PROXY STATEMENT 24

| Nominating and Corporate Governance Committee | |

Members: 3 • Stanley B. Stern (Chair, pictured) • David Granot • Dafna Sharir Number of Meetings in 2023: 2 | Key Responsibilities: • Develops criteria and qualifications for Board membership • Identifies and approves individuals who meet Board membership criteria and are qualified to serve as members of our Board • Recommends director nominees for our annual meetings of stockholders • Recommends Board members for committee service • Develops and recommends to our Board corporate governance guidelines • Reviews the adequacy of our certificate of incorporation and bylaws • Reviews and monitors compliance with our Corporate Governance Guidelines • Oversees the evaluation of the Board and • Makes independence determinations and |

Members: 3 • David Granot (Chair, pictured) • Mike Nikkel • Stanley B. Stern Number of Meetings in 2023: 2 | Key Responsibilities:

• Considers and, as applicable, approves and authorizes hedging transactions we may enter into to hedge our exposure to certain risks and currencies in accordance with the • Meets on an as-needed basis as instructed by our |

Members: 3 • Karin Corfee (Chair, pictured) • David Granot • Byron G. Wong Number of Meetings in 2023: 2 | Key Responsibilities: • Reviews and makes recommendations to the • Reviews the Company’s reporting on ESG performance, including the Company’s annual sustainability report • Reviews and recommends strategies to reduce the Company’s carbon footprint and other environmental risks • Assess the Company’s climate-related risks and opportunities, and review and recommend strategies to reduce its carbon footprint and other environmental risks. |

ORMAT TECHNOLOGIES, INC. | 2024 PROXY STATEMENT 25

| Time commitment and expectation on meeting attendance and active participation | • All directors are expected to make every effort to attend our annual meeting of stockholders. • All directors are expected to make every effort to attend all meetings of the Board and meetings of the committees of which | |